As we have an understanding of the means of transportation not being limited to the road [vehicles], the waterways are not excluded from the place of security, since they are also as vulnerable as every other means of transportation.

The word marine is usually anything that is related to or something found with the sea; this should therefore give an idea of what our scope of the article will be for today.

In today’s read, I will be sharing with you some insights on marine insurance, if mandatory or otherwise, the 5 principles, the examples, what is covered and not, the types, the benefits, and risk among others of marine insurance.

You can have your SEO and Digital marketing worries sorted with The Watchtower - Web Design Agency Dubai.

What is Marine Insurance?

Marine insurance is a form of security covering initiated for anything that has to do with the waterway's transportation. This type of insurance covers the loss or damage of a ship, cargo, or any item that is transported through the sea.

What are two types of marine insurance?

4 types of marine insurance are independent of themselves, however, two types of insurance find general appeal more, they are:

1. Hull Insurance

Hull insurance is a form of marine insurance that is purchased by the owner of the vessel to cover any possible risk provided in the quote while buying a policy.

2. Cargo insurance

This is a type of marine insurance usually initiated by the owner of the goods to be shipped rather than the vessel owner.

What is the example of marine insurance?

Marine insurance is a protective cover that binds the insurance provider and the policyholder in the event of a casualty or form of loss addressed in the policy. Some examples of marine insurance are Freight insurance and Cargo insurance.

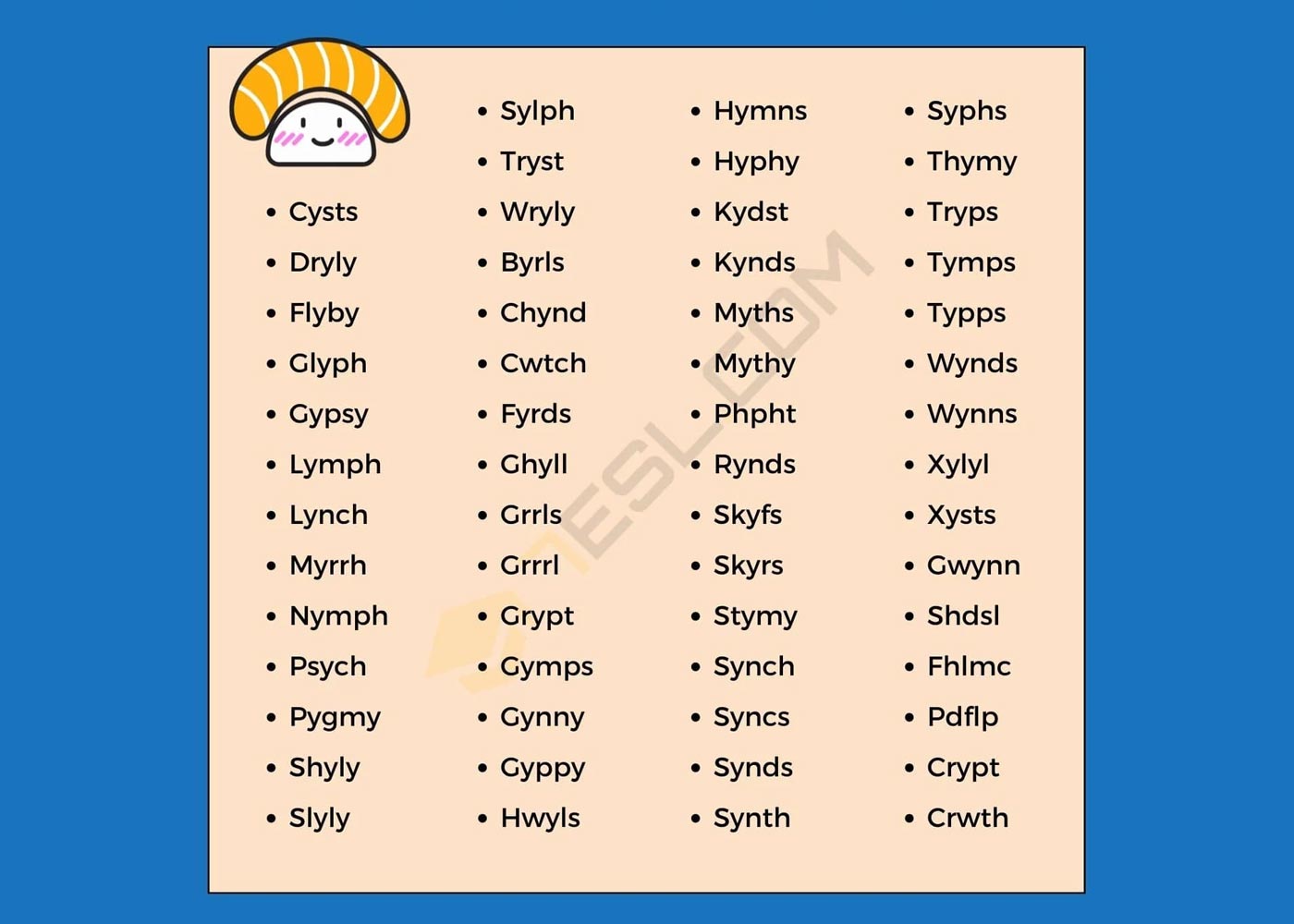

What are the 5 principles of marine insurance?

In marine insurance 5 principles bind the process which was derived from the Marine Insurance Act of 1963, they are:

1. Indemnity.

2. Insurable Interest.

3. Utmost Good Faith.

4. Proximate Cause

5. Subrogation, and Contribution in all property insurance contracts.

How many types of marine insurance are there?

There are 4 types of marine insurance namely:

1. Cargo insurance.

2. Freight revenue insurance.

3. Negligence insurance.

4. Hull insurance.

What is the benefit of marine insurance?

The main benefit of buying a marine insurance policy is that it offers comprehensive protection against a wide range of dangers encountered at sea. Most marine insurance companies give claim surveys and settlement support all around the world.

The benefit of marine insurance goes in many directions if details need to be said, however, the ultimate goal is to secure properties being transported via the waterways in case there is any loss or damage.

What is not covered in marine insurance?

It becomes better to understand what is covered or not in a marine insurance policy. In tune with this, the following situations are not covered by marine insurance except Loss or damage as a result of a deliberate act of carelessness or misbehaviour. Any loss or damage incurred as a result of the delay. Inadequate packing results in loss or harm.

What are the 3 significant types of insurance that are involved in marine insurance?

In Marine insurance, there are three significant types of insurance namely:

1. Freight insurance.

2. Cargo insurance.

3. Hull insurance.

What is the risk in marine insurance?

All-risk marine insurance is cargo insurance that covers any case of theft, loss, or damage to one’s cargo, as the name implies. The insurance coverage is comprehensive, covering the following situations of theft, loss, or damage as the case may be respectively.

In conclusion, if you have your business tied to the waterways as a means of transportation or providing services on the sea, it is better that you have yourself worthy insurance like marine insurance.

Comments (0)

Write a Comment